The Benefits of Freddie Mac's CHOICERenovation Loan

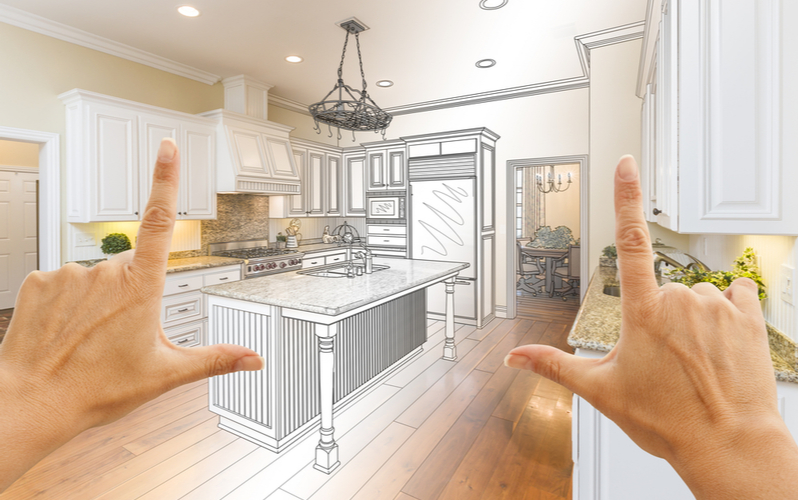

The Freddie Mac's CHOICERenovation Loan is a great solution for potential homeowners who are looking to buy a property that they must repair and renovate. Potential homeowners looking at Âfixer-uppers can really benefit from this loan that allows them to roll in the costs of renovations into their new mortgage. This saves time and money for a new homeowner and helps maintain and give selling potential to properties in need of repairs across the country.

The CHOICERenovation loan can also be used to repair properties that have been damaged from natural disasters when they include repairs that will prevent future damage. This loan is meant to help the aging housing supply across the country and expand buying opportunities for first-time homeowners.

Is This Loan Right for Me?

While the Freddie Mac CHOICERenovation loan is open to all eligible borrowers, there are certain people who can benefit from it more than others such as:

- First time homebuyers looking to stretch their budget and expand their options to properties they would not normally consider because they could not afford to finance the repairs.

- Buyers in rural communities where the home supply is less than its major city counterparts.

- Aging homeowners who are looking to finance repairs while staying in their homes.

- Homeowners who plan to keep their home for multiple generations and want to spend money customizing renovations tailored to their living style and preferences.

How CHOICERenovation Works

A borrower can finance repairs that cost up to 75% of their home's value after renovation. A qualified lender can help borrowers narrow down these figures and customize estimates based on the properties the borrowers are interested in. The key is whatever figure you are aiming for, you must be credit worthy to qualify.

Freddie Mac's CHOICERenovation loan uses the same debt-to-income ratios that most lender and mortgage programs are based upon. However, it expands your options as a homebuyer and should be considered when shopping around for your new property.

Your Choice for Superior Mortgage Lending

If you need assistance finding the right loan to help fund your home repairs, then contact Butler Mortgage. With over 25 years' experience, the professionals at Butler Mortgage can help you find the best loan solution to satisfy your needs. To get started, call us today at 407-931-3800 or fill out our free consultation form online.